Send personal guarantee form pdf via email, link, or fax. You can also download it, export it or print it out.

Working on paperwork with our feature-rich and user-friendly PDF editor is easy. Adhere to the instructions below to fill out Business credit application with personal guarantee online easily and quickly:

Make the most of DocHub, one of the most easy-to-use editors to promptly handle your documentation online!

Fill out business credit application with personal guarantee onlineWe have answers to the most popular questions from our customers. If you can't find an answer to your question, please contact us.

Is collateral same as personal guarantee?Collateral ties a loan to a specific asset, like your business's inventory or your home, which the lender can seize if your business can't repay the loan. A personal guarantee promises the lender that you will repay the debt using your personal assets, but may not specify how.

Why do I have to personally guarantee a business loan?Personal guarantees on business loans are designed to reduce a bank's risk in lending out money to business owners who may not have a proven track record of repaying loans. In order for a lender to go without personal guarantees, they must have some other way of reducing their risk as they lend to new clients.

Is personal guarantee a hard inquiry?When a personal guarantee is used, the applicant includes their Social Security Number (SSN) for a hard credit inquiry as well as details about the individual's personal income. This information is in addition to the company's employer identification number (EIN) and financial statements.

Does a personal guarantee show up on credit report?Personal guarantees don't have a direct impact on your personal or business credit history, or credit score unless you run into trouble. "They don't typically show up on credit reports," Luebbers says. But, a personal guarantee could affect your credit if you have late payments or default on the loan.

What is an example of a personal guarantee?Corporate credit cards that are issued to an individual are another example of a personal guarantee. The individual or employee is responsible for the debt that the organization takes on and the overall spending on the credit card. Here, the cardholder takes the role of a guarantor.

business credit application with personal guarantee template personal guarantee loopholes personal guarantor for business credit what is a personal guarantee on a loan personal guarantee limited company personal guarantee template uk personal guarantee insurance personal guarantee example

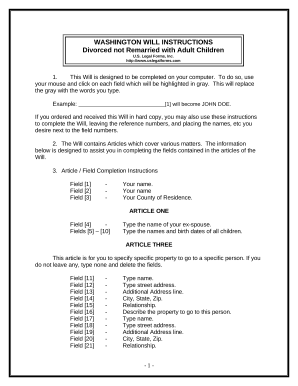

Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children - Washington

Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children - Washington